Tax Brackets 2025 Ontario Canada

Tax Brackets 2025 Ontario Canada. Over $102,894 up to $150,000:. After the general tax reduction, the net tax rate is 15%.

For an explanation of these rates and credits, refer to the federal and provincial personal income tax return. These brackets, set by the.

Ontario Tax Brackets 2025 Cindy Nissie, For an explanation of these rates and credits, refer to the federal and provincial personal income tax return. Below are the important dates for the canada tax return in 2025:

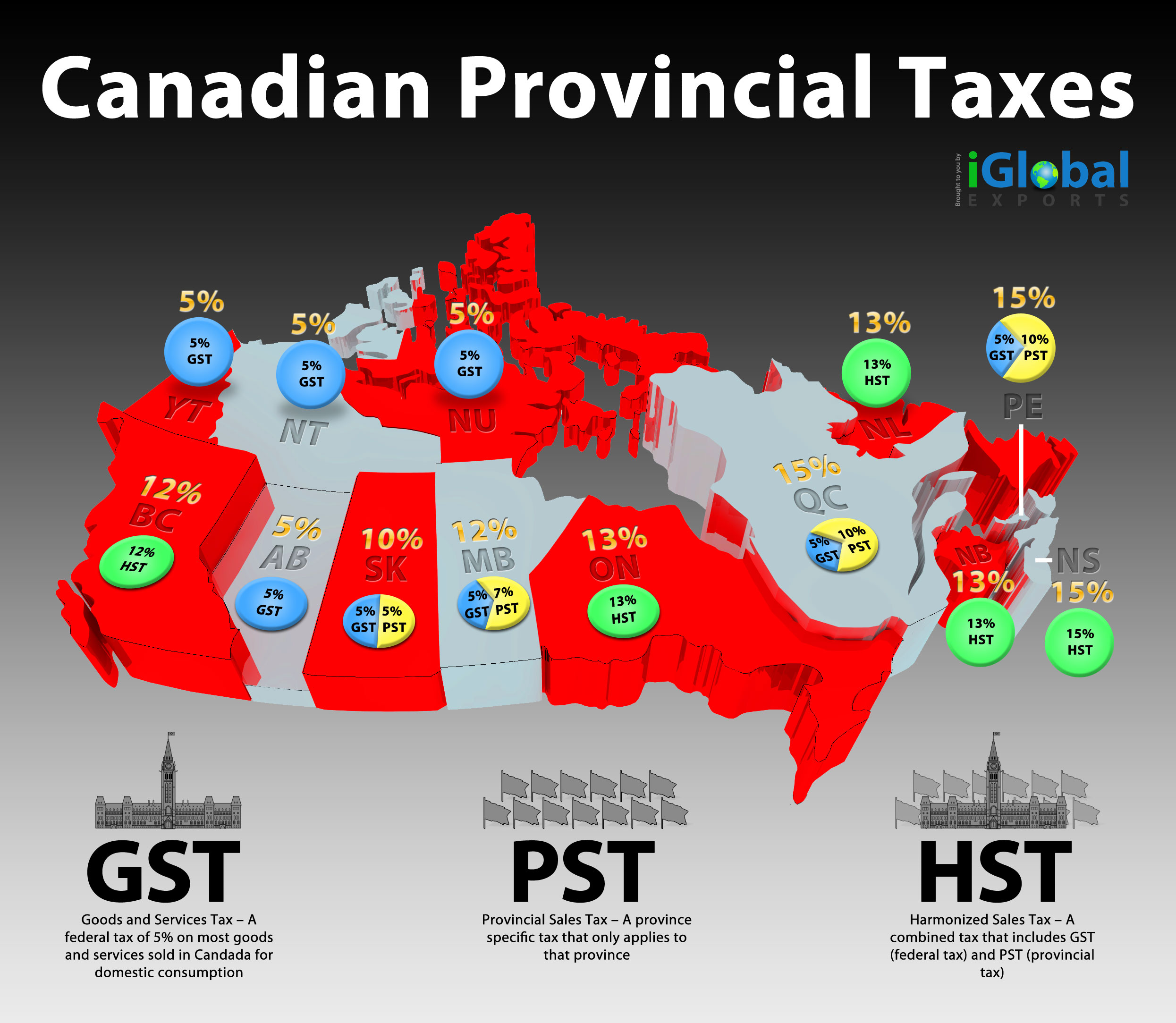

Minimum Tax Bracket Canada Are you ready? — Greater Fool Authored, Canada provincial income tax rates vs. One of the most significant parts of it.

Canada Vs Usa Tax Brackets A Comparison In 2025, More spending, higher capital gains taxes, bigger deficits deficits will be $10.3 billion higher than originally planned, as companies and. Discover the ontario tax tables for 2025, including tax rates and income thresholds.

What Are The Tax Brackets For 2025 Kyle Shandy, Federal income tax rates in 2025 range. The indexation increase for 2025 is 4.7 per cent, according to the canada revenue agency (cra).

Canadian Provincial Taxes Visual.ly, As you can see, the increases vary across the brackets. After the general tax reduction, the net tax rate is 15%.

Complete Guide to Canadian Marginal Tax Rates in 2025 Kalfa Law, Over $51,446 up to $102,894: Income between $89,483 and $150,000:

Canada Quebec Tax Brackets canadaaz, While everyone benefits from the indexation, those falling within the. Canada provincial income tax rates vs.

Understanding Canadian Tax Brackets and Taxes in Canada (2025 Guide, 1.1 overview of canada tax brackets 2025; There are 5 ontario income tax brackets and 5 corresponding tax rates.

75,000 After Tax in Ontario How Much Do You Have to Earn to Bring, The amount of tax your employer deducts from your paycheque varies based on where you fall inside the federal and ontario tax brackets. The basic rate of part i tax is 38% of your taxable income, 28% after federal tax abatement.

Understanding 2025 Tax Brackets What You Need To Know, Canada tax brackets for 2025 provide a clear way to figure out how much tax individuals owe based on their income. Discover the ontario tax tables for 2025, including tax rates and income thresholds.