Irs Interest Rates 2025 On Payment Plans

Irs Interest Rates 2025 On Payment Plans. This plan gives them an extra 180 days to pay the balance in full. Determining sufficient funding requires calculating the present value of future benefits which is, in part, based on discounting those benefits with interest.

How to find out how much you owe in irs back taxes strategies for managing your tax bill on deferred compensation video: Corporations (payments up to $10,000):

Irs Interest Rates 2025 Individual Lari Sharia, If you’ve found yourself facing an overwhelming tax bill, you may need to set up a payment plan with the irs.

IRS Announces Interest Rates for Q3 of 2025 Optima Tax Relief, 8% for overpayments (7% for corporations) 8% for the underpayment of taxes.

Irs Interest Calculator 2025 Dacia Dorotea, The irs offers additional time (up to 180 days) to pay in full.

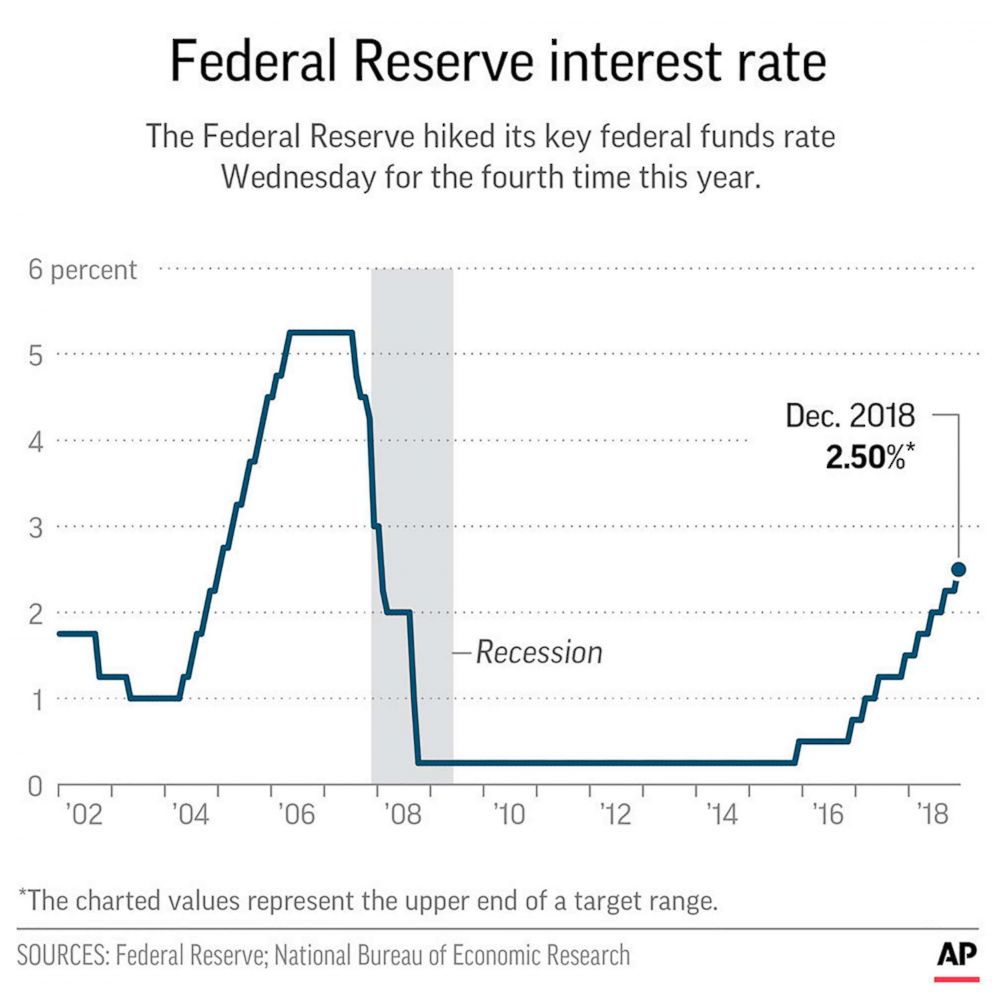

What Will Interest Rates Be In 2025 Nona Thalia, The irs interest rate for installment agreements is 8% as of march 2025.

Tabelas IRS de 2025 saiba quanto vai receber a mais este ano Forever, 10% for large corporate underpayments.

Trading The Updated Interest Rate Outlook For 2025 Seeking Alpha, Here’s how taxpayers know when it’s the irs that contacts them.